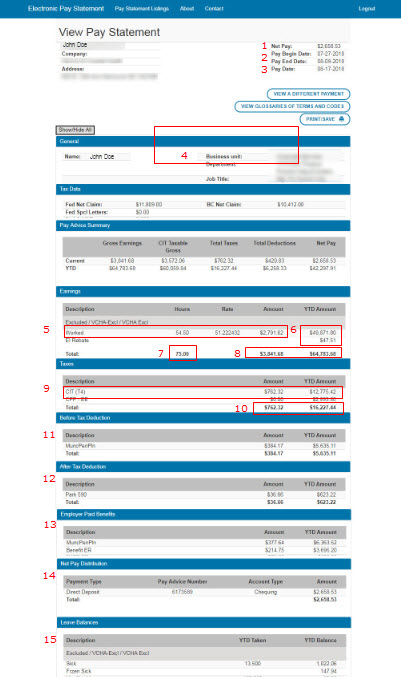

| Your pay statement decoded | ||

| 1 | Net Pay | Gross pay – (Income Tax + CPP + EI + Total Deductions) |

| 2 | Pay Period Begin Date and End Date | Date range of pay period being viewed |

| 3 | Payment Deposit Date | Pay statement deposit date |

| 4 | General |

Business Unit: Organization of your employment Department: Department code or cost center of employment Job Title: Your job title |

| 5 | Earning Types | Number of earned hours in the pay period and hourly rate per type of earned hour |

| 6 | YTD Earnings | Year to Date totals by earning type |

| 7 | Total Hours | Total number of hours paid in the pay period |

| 8 | Gross Pay | Earned hours x hourly rate |

| 9 | Deductions | Deductions for Income Tax (CIT), Canada Pension Plan (CPP) and Employment Insurance (EI) |

| 10 | Tax Deduction Total | Current and Year to Date totals for deductions (CIT + CPP + EI) |

| 11 | Before Tax Deductions | Itemized deductions before tax |

| 12 | After Tax Deductions | Itemized deductions after tax |

| 13 | Summary of Benefits | Current and YTD totals for any Employee Paid Benefits (ie, MSP, Dental, Extended Health, etc) |

| 14 | Pay Distribution | Method of payment details |

| 15 | Leave Balances | Leave entitlement balance in hours as of pay period end date |